FREIGHT OFFERS REPORT EUROPE

FIRST SEMESTER 2022

Once we have reached the half of the year, we can confirm that the road freight transport has stabilized, with numbers very similar to those of last year. This is what the data in Teleroute shows, the leading freight exchange in Europe.

Although numbers are slightly lower than those of 2021, clearly conditioned by the conflict in Ukraine and its consequences, including inflation and rising fuel costs, in this first half of the year, over 33 million loads were offered via Teleroute, almost double than the numbers recorded in the same period of 2020.

We can therefore say that the situation on the continent has conditioned the number of freight offers in the last three months, but in no case has it led to a worrying decrease. The results are very similar to those of 2021, a particularly good year for transportation, and are well above those of 2020, in a quarter that coincided with the industry's recovery from the first wave of the pandemic.

Towards the summer season

As we enter the summer season many carriers take the opportunity to rest before their return to the road in September, while others will continue expanding their business. In this sense, the numbers we see after these three months will depend on the evolution of the events we are currently experiencing. Taking into account that the COVID-19 restrictions are now practically non-existent, we foresee a lot of travel and consumption that will probably favor the activity.

In the meantime, we analyze the stabilization of freight offers mentioned above, reviewing the results of exports, imports, and the domestic market.

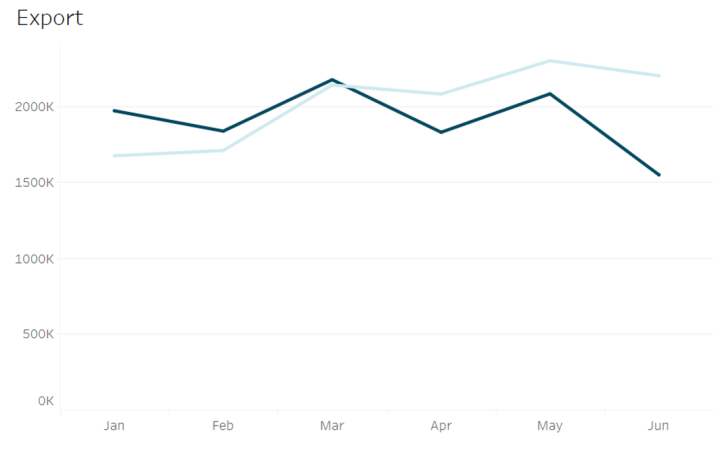

EXPORT

Export freight offers are down 5% compared to the first half of 2021, following a slight decline in some markets. The macroeconomic situation in Europe is playing a decisive role in these results. Particularly for export, where there is no doubt that many plans have been altered as a result of the conflict in Ukraine. Furthermore, the inflation that is currently affecting most European countries should be also considered, as it has been making the prices of goods (including fuels) more expensive. As a result, citizens are consuming less and there are fewer products to export.

It is the first times that Germany doesn't have a surplus in it economy and the numbers for exports decline are also seen on Teleroute. This market has lowered its exports in a –9%. We can deduct this I due to the country’s location, since Germany on countries involved in the Ukrainian conflict for its gas and oil supplies.

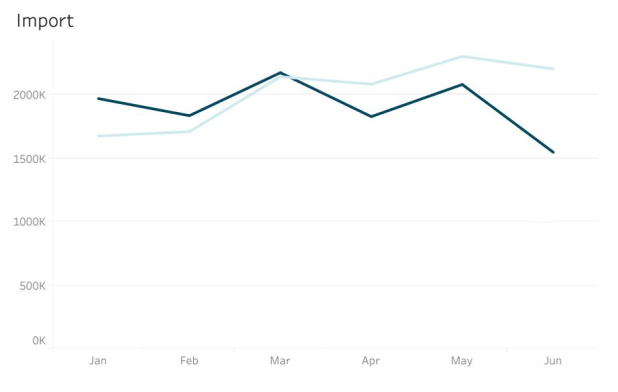

IMPORT

There has also been a small decrease of 6% in imports, also conditioned by the previously mentioned factors. Access to certain trade routes has been affected and, as we will see below, an increasing number of carriers are opting for alternatives within their own country. However, the percentages are not bad, and we have an import market that comfortably exceeds eleven million offers of freights.

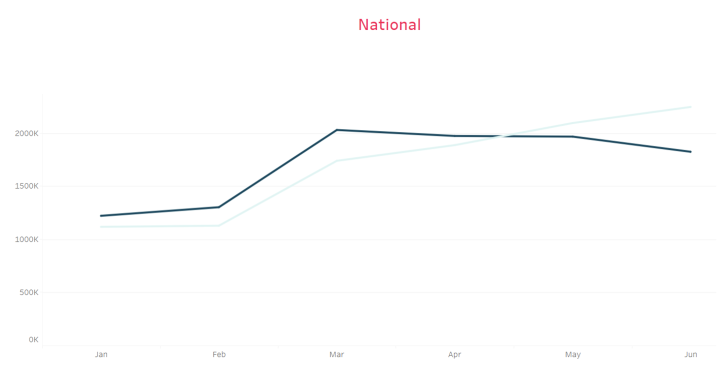

DOMESTIC TRANSPORT

In view of the above, the growth experienced in freight offers at the national level is not surprising. We found a 1% growth on the number of freight offers in the domestic market.

In this regard, freight offers with origin and destination in the same country now exceed 10 million, almost on a par with the same period last year. This growth has been noticeable in important markets such as Italy and Germany, with 24% and 48%, respectively. France should also be mentioned, where the sum of freight offers for these first six months of the year has exceeded two and a half million, which is 4% more than in the same period of 2021.

These data show not only the significant percentage of national transport offers on our platform, but also that there are more and more of them, which offers drivers a wide range of possibilities both inside and outside their home country. After all, many carriers still prefer to work within their own country, and, with Teleroute's tool, they have thousands of offers available every day for both domestic and international routes.